Unsecured NPL Europe

Fund Portrait

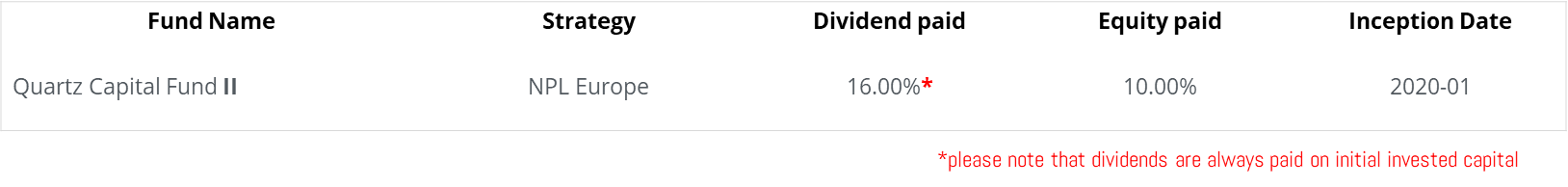

The principals of the GP are specialized since 1985 in the purchase of selected overdue invoices and default recipients. These are usually bought between 1% and 4 % of the initial value and recovered by WCMG Group through their offices around Europe. All functions are in house making WCMG a one-stop shop. Next to the 8% yearly yield (on the initial invested money), capital is paid back throughout the life of the Funds bringing the strategy targets to an IRR of approx. 15% p.a.This strategy is suitable for long-term investors looking for regular and consistent performance. Fund I was launched end of year 2017 and has been liquidated, as per business plan, with the expected returns during 2023. Fund II is on its third year of activity with similar results as Fund I and Fund III is currently open for new subscriptions.

| INVESTMENT MANAGER | MC Square Independent Management |

|---|---|

| TYPE STRUCTURE | Luxembourg SICAV-SIF |

| DOMICILE | Luxembourg |

| DISTRIBUTOR SWITZERLAND | OpenFunds Investment Services AG (Switzerland) |

| AUDITOR | Deloitte, Luxembourg |

| CUSTODIAN | Natixis Bank, Luxembourg |

| REGULATOR | Commission de Surveillance du Secteur Financier, Luxembourg (CSSF) |

| PAYING AGENT SWISS | Società Bancaria Ticinese SA (Switzerland) |

| GEOGRAPHY | Europe |

| STRATEGY | Bank portfolios – bank loans and personal loans; Financial portfolios – consumer credit, personal loans, credit cards; Leasing portfolios; Utilities and telco commercial papers and unpaid bills |

| SHARE CLASSES | Retail and institutional |

| CURRENCY | EUR |

| INITIAL CHARGES | 0% |

| SUBSCRIPTIONS | Open for subscriptions |

| MINIMUM INVESTMENTS | Retail: 125,000 EUR; Institutional: 5,000,000 EUR |

| LIQUIDITY | Possibility of exiting after year 3 |

| MANAGEMENT FEE | up to 2% |

| PERFORMANCE FEE | 0% |

| MANAGER TRACK RECORD | Since 1970's with proprietary moneys |

| ISIN | LU1492828402 - retail (below 1mio EUR subscriptions) / LU1492828824 - institutional (above 1mio EUR subscriptions) |