Absolute Return Fund IV

Fund Portrait

The Absolute Return Fund IV is a closed-end investment fund managed by Carlisle Management Company S.C.A., operating under the Abacus Global Management brand. The fund targets a net annualized return of 15%+ by investing in the U.S. secondary life insurance, policies sold by seniors who no longer need or can afford them.

Leveraging over 80 years of combined team experience and a proprietary direct-to-consumer sourcing platform, the fund builds diversified portfolios optimized through rigorous actuarial underwriting and stress testing. With low correlation to traditional financial markets, high credit quality, and predictable, self-liquidating cash flows, the fund offers institutional investors a socially responsible and capital-efficient alternative asset class. The fund is structured to deliver quarterly distributions and aims to fully deploy committed capital within 10–12 months.

| INVESTMENT MANAGER | Carlisle Management Company |

|---|---|

| LINKEDIN COMPANY PAGE | Abacus Global Management |

| FUND | Absolute Return Fund IV |

| TYPE STRUCTURE | AIFMD-compliant fund |

| DOMICILE | Luxembourg |

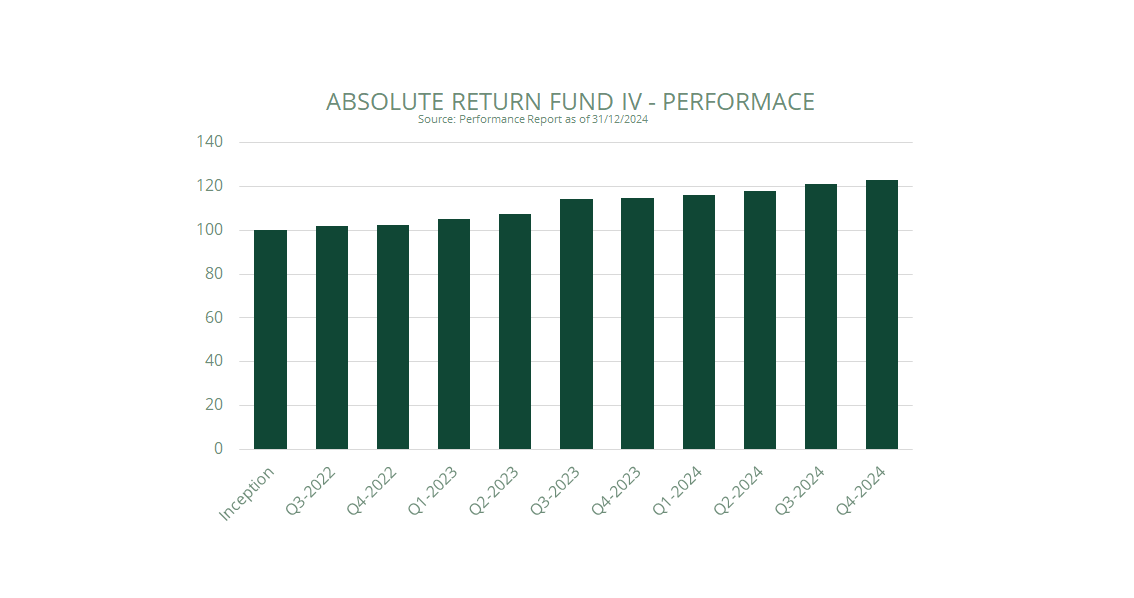

| LAUNCH DATE | March 31, 2022 |

| DISTRIBUTOR SWITZERLAND | OpenFunds Investment Services AG (Switzerland) |

| AUDITOR | KPMG Luxembourg |

| CUSTODIAN | Caceis Bank Luxembourg |

| REGULATOR | CSSF |

| PAYING AGENT SWISS | REYL & CIE LTD |

| GEOGRAPHY | U.S. life settlement market |

| SECTOR | Secondary life insurance |

| SHARE CLASSES | - |

| CURRENCY | USD, EUR, CHF |

| INITIAL CHARGES | - |

| MINIMUM SUBSCRIPTION | USD 1 m (or equivalent) |

| LIQUIDITY | Quarterly NAV, term of 10 years |

| MANAGEMENT FEE | 1.5% |

| PERFORMANCE FEE | 20 % with 6% hurdle |

| FUND SIZE | USD 250m |

| MANAGER TRACK RECORD | - |

| ISIN | Please refer to the factsheets |

| SFDR CLASSIFICATION | - |